Over the long run, shares have historically furnished advancement. Nevertheless, in exchange for this likely development, investors suppose challenges that go effectively outside of the pitfalls of preset income investments like bonds.

Income market place accounts effectively function as being a variety of price savings account, other than they may present bigger desire fees and incentives the extra money you deposit. Additionally, they’re FDIC-insured around $250,000 and a superb brief-term financial commitment selection for those new to investing or hesitant about investing.

Moreover, there will often be considered a minimal harmony that need to be preserved. Understand that there might also be monthly costs or restrictions on how much you'll be able to withdraw, based on the institution.

Also, there is one thing termed a variable annuity, in distinction to a hard and fast annuity, which includes getting greater pitfalls with all your expenditure. Other disadvantages include things like substantial costs and a lack of liquidity.

Individual FINANCE Girl retailers on earth's most expensive supermarket — her jaw dropped when she noticed the cost of berries The TikTok information creator and her Close friend guessed that the cost could be larger than normal but still acquired it Erroneous. Oct twelve, 2024

Ideal of economic downturn – The appropriate of the borrower to terminate the deal inside of just three Functioning days.

Variable fascination fee – That is an desire level which is able to modify based on the current index, like a main charge.

See Retirement program and IRA needed minimal distributions FAQs For additional detailed information regarding the new provisions while in the legislation.

As soon as the individual properly rolls in excess of the existing belongings get more info in the employer's strategy, they must be relieved of having to acquire once-a-year RMDs from all those belongings. The wild card With this state of affairs is almost always the approach doc and administrator.

Also, for those who read even further, We're going to provide you with some helpful retirement withdrawal techniques by detailing tips on how to withdraw income from a retirement account.

Credit line – This really is also typically referred to non-public line of credit and is particularly the utmost quantity someone could possibly get from her or his account. As soon as the credit history line is repaid the individual can then re-borrow from this account.

Whether the initial account proprietor passed absent in advance of or after their necessary commencing date (the date the first account proprietor was needed to start getting RMDs).

Secured mortgage – This is a bank loan exactly where the borrower will pledge his asset just like a car or truck or house which is able to be bought if he is not able to spend back the loan.

This timeless comment, passed down for generations, is usually a traditional phrase In regards to investing. Whether or not you are just beginning your investing journey, taking pleasure in retirement, or at any place between, possessing the correct mixture of investments (often called "asset allocation") can help you weather the industry's ups and downs and pursue your ambitions.

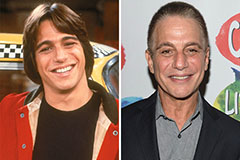

Tony Danza Then & Now!

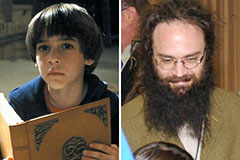

Tony Danza Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!